Introduction to Collections Outsourcing

Outsourcing collections has emerged as a strategic approach for businesses seeking to enhance their financial management processes. This practice involves delegating the task of recovering outstanding debts to specialized third-party providers, commonly referred to as collections call centers. These entities are equipped with the expertise and infrastructure necessary to efficiently manage the collections process, allowing businesses to focus on their core operations.

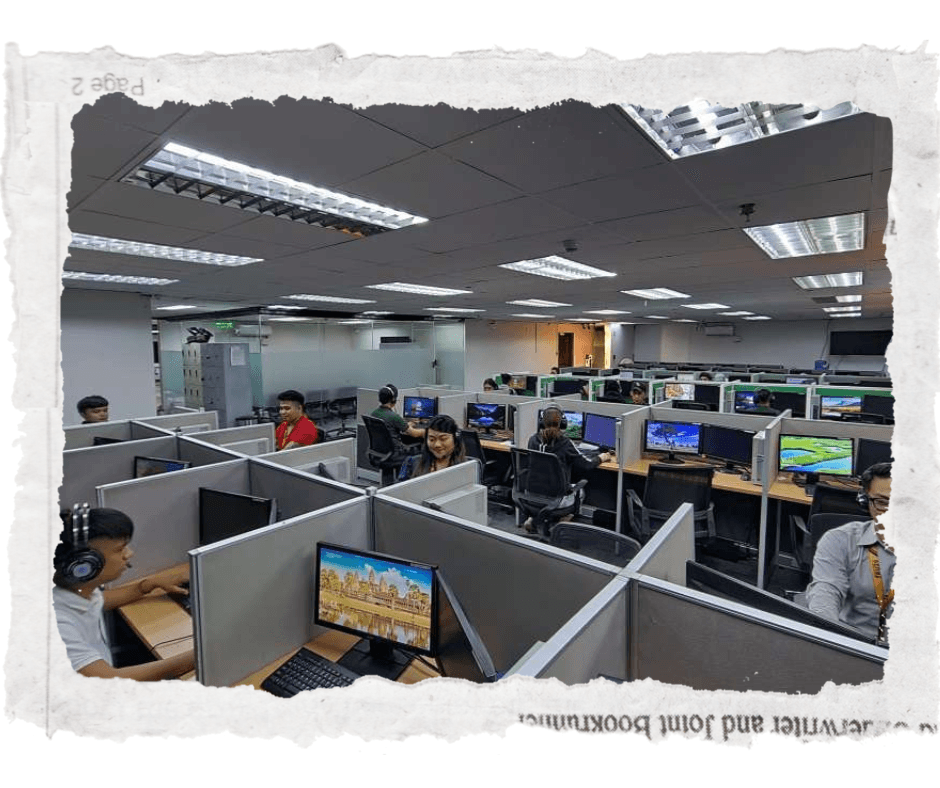

The global trend of outsourcing spans numerous sectors, but it is particularly prominent in the finance and credit management industries. In an increasingly competitive marketplace, organizations face the pressing need to streamline their operations and improve cash flows. By utilizing the resources of a Philippine call center, companies can benefit from cost-effective solutions while ensuring that collections are handled professionally and effectively.

Moreover, outsourcing collections provides access to advanced technologies and techniques that in-house teams may not readily possess. Collections call centers bring sophisticated software and trained personnel that can enhance the recovery rates of outstanding debts. As a result, businesses are not only able to mitigate financial risks but also improve their overall customer experience. Outsourcing allows for a courteous approach to collections, which can positively impact client relationships and foster long-term loyalty.

This evolving landscape reflects a significant shift in how businesses perceive their collections efforts. Rather than viewing collection processes as mere transactional encounters, organizations are beginning to understand the value of outsourcing as a means to optimize their debt recovery efforts while ensuring compliance with regulatory requirements. As we explore the benefits of collections outsourcing in detail, it becomes clear why this approach is gaining traction across various sectors.

Cost Savings and Financial Efficiency

Outsourcing your collections process can produce substantial cost savings for businesses, significantly impacting overall financial efficiency. One of the primary areas where companies experience savings is in overhead costs associated with staffing. By utilizing a collections call center, businesses can avoid the expenses tied to hiring, training, and maintaining an in-house collections team. This is particularly beneficial for smaller organizations that may not have the resources to support full-time staff dedicated to collections.

Furthermore, the investment in technology needed to manage collections effectively can be a burden for many businesses. This includes the costs related to customer relationship management (CRM) systems, automated dialing systems, and other software necessary for efficient operations. Outsourcing collections allows companies to leverage the expertise and technology of specialized providers, such as a Philippine call center, which often have advanced systems already in place. This not only reduces initial capital expenditures but minimizes ongoing maintenance expenses as well.

Another advantage of outsourcing collections is the ability to scale services according to the business’s needs. A collections call center can adapt quickly to increases or decreases in collections volume, avoiding the fixed costs associated with permanent staff. This flexibility enables businesses to allocate resources more effectively, ultimately leading to better financial performance. Moreover, with optimized collections processes in place, businesses can enhance cash flow and increase recoveries, thereby improving their overall financial health.

In conclusion, the advantages of outsourcing collections are evident in the significant cost savings and financial efficiency it provides. By reducing overhead costs associated with staffing, training, and technology and allowing for greater flexibility in operations, businesses can redirect their funds toward more critical activities, fostering growth and sustainability in competitive markets.

Access to Expertise and Resources

Outsourcing collections to specialized agencies can provide businesses with a significant advantage due to their expertise and resources. Third-party collection agencies, equipped with trained professionals, have made it their mission to master the art and science of debt recovery. These agencies employ skilled staff who are well-versed in the latest collection strategies and regulations, ensuring that they operate within legal boundaries while maximizing recovery rates. Their expertise enables them to handle complex situations that in-house teams may find challenging, particularly when dealing with accounts that require a delicate approach.

Moreover, these collection agencies utilize advanced tools and software solutions tailored specifically for the collections process. Such technology allows for efficient tracking of accounts, streamlined communication, and data analysis, all of which enhance the collection efforts. For example, a Philippine call center specializing in collections may use automated dialing systems and data analytics to prioritize accounts based on the likelihood of recovery. This technological edge not only speeds up the collections process but also reduces operational costs, making it a strategic choice for businesses looking to enhance their financial performance.

Additionally, by outsourcing to a collection agency, businesses gain access to a wealth of resources that may not be readily available in-house. This includes training and ongoing professional development for collection staff, as well as a network of industry contacts that facilitate knowledge sharing and best practices. These elements are crucial in adapting to the ever-evolving landscape of debt collection. Hence, leveraging these specialized resources allows businesses to concentrate on their core operations while ensuring that their accounts receivable are efficiently managed. The collective expertise and innovation that comes with outsourcing to a dedicated collections call center can lead to sustainable financial success.

Improved Cash Flow Management

Outsourcing collections processes to specialized agencies can significantly improve cash flow management for businesses. One of the primary advantages of utilizing a collections call center is the expertise these professionals bring to the table. By employing trained collections specialists, companies can ensure that their outstanding debts are pursued promptly and effectively, thereby enhancing liquidity.

Timely collection of receivables is crucial for maintaining a steady cash flow. When businesses allocate their collections tasks to a Philippine call center, they benefit from the round-the-clock availability of skilled agents who can pursue debts across various time zones. This proactive approach decreases the average days sales outstanding (DSO) and minimizes the likelihood of overdue accounts. Consequently, improved cash flow allows organizations to allocate financial resources more effectively for operational improvements and growth initiatives.

Moreover, outsourcing collections enables businesses to focus on their core competencies without the distraction of managing debt recovery. This strategic delegation allows for better resource allocation; companies can invest more time and energy into product development, marketing, and customer service, ultimately driving revenue and growth. Outsourced collections teams utilize best practices and advanced technology to manage accounts receivable effectively. Their data-driven strategies help in identifying accounts at risk and implementing tailored action plans that optimize collections.

Furthermore, outsourcing collections mitigates the risks associated with cash flow uncertainty. With predictable inflows from improved collections, financial stability is enhanced, facilitating well-informed strategic decisions. This stability is vital for long-term growth, as it empowers businesses to invest in new ventures or expand existing ones confidently.

Enhanced Customer Relationships

Many businesses perceive outsourcing collections as an aggressive tactic that could damage customer relationships. However, this perception fails to recognize the professionalism and sensitivity that reputable collections call centers bring to their operations. In reality, professional collection agencies understand the delicate nature of debtor interactions and prioritize customer satisfaction alongside the objective of recovering outstanding debts.

Outsourcing collections to specialized firms allows companies to benefit from the expertise of trained professionals who employ effective communication techniques. These professionals are adept at facilitating pleasant conversations, focusing on problem-solving and understanding customers’ individual circumstances. As a result, customers are more likely to feel respected and understood during the collections process, which can fortify their connection to the brand.

When a company delegates its collections efforts to a Philippine call center with a strong reputation for customer service, it not only enhances its collections process but also protects the company’s image. The call center agents are equipped with skills to handle sensitive situations thoughtfully and with empathy. This empathetic approach minimizes the risk of customers feeling alienated or undervalued, paving the way for a more positive customer experience.

Moreover, maintaining open lines of communication with customers during the collections process can foster loyalty. By outsourcing collections, businesses can ensure that customers receive timely follow-ups and consistent messaging, creating an environment where customers feel informed and engaged, rather than pursued aggressively for debts.

In this manner, outsourcing collections is not merely about recovering financial resources; it’s an opportunity to strengthen customer relationships. When customers see that a company values their circumstances and addresses their needs with care, it sets the stage for future engagement and retention, ultimately benefiting the overall brand reputation.

Focus on Core Business Functions

Outsourcing collections can be a strategic decision for organizations seeking to enhance their operational efficiency and effectiveness. By transferring the management of collections to specialized entities, such as a Philippine call center, businesses can redirect their focus towards core functions that truly drive growth and innovation. This shift in focus enables companies to better allocate their internal resources to areas such as product development, customer service enhancement, and strategic planning.

Handling collections internally can often lead to distractions and resource drain. The time spent on managing collections processes, handling customer calls, and following up on overdue payments can detract from essential business activities. In contrast, when collections are outsourced, organizations can streamline their operations. This allows teams to concentrate on refining their business strategies and improving their offerings without the burden of overdue accounts weighing them down.

The collaboration with a dedicated collections call center allows businesses to leverage the expertise and infrastructure of professionals who specialize in this field. Such a partnership ensures that collections are managed efficiently, which typically results in improved recovery rates and customer satisfaction. Moreover, this approach can provide valuable insights into market trends and customer behaviors, which can inform future business decisions.

Ultimately, outsourcing collections is not just about freeing up time; it is about fostering a culture of growth and innovation. By alleviating the collection burdens from in-house teams, organizations can create a more conducive environment for creativity and development. As a consequence, this leads to a stronger competitive position within the market and enhanced long-term success for the business.

Adaptability and Scalability in Collections Outsourcing

Outsourcing collections to specialized agencies, such as those based in the Philippines, allows businesses to benefit from enhanced adaptability and scalability. One of the fundamental advantages of engaging third-party collections call centers lies in their ability to swiftly respond to changing market conditions and account volumes. For instance, during periods of economic downturn or growth, the demand for collections services may fluctuate significantly. In such cases, outsourcing provides organizations with the flexibility to adjust their resource allocation without the burden of hiring or training new staff.

Third-party collections call centers are equipped to scale operations up or down efficiently. When account volumes increase, these agencies can quickly ramp up their workforce to manage the higher demand. Conversely, in less busy periods, they can just as easily reduce their capacity. This level of flexibility is often unattainable for in-house teams that may be constrained by fixed overhead costs and staffing limitations. Outsourcing eliminates the need for businesses to make long-term commitments regarding staffing, providing a more responsive and cost-effective solution.

Furthermore, the adaptability of outsourced collections teams allows organizations to focus on their core functions rather than being preoccupied with fluctuations in collections. These agencies often have the infrastructure, technology, and expertise to implement rapid changes in strategy or processes, ensuring continual alignment with evolving business objectives. By leveraging the capabilities of a collections call center, businesses can maintain a focus on their growth while entrusting their collections needs to adept partners. This synergy between adaptability and scalability showcases the substantial benefits that outsourcing delivers.

Legal Compliance and Risk Management

When it comes to managing collections, the legal landscape is complex and constantly evolving. Companies that choose to handle collections in-house may inadvertently overlook critical compliance requirements, potentially exposing themselves to significant legal risks. Outsourcing collections to specialized agencies, particularly those operating from a Philippine call center, enables businesses to leverage the expertise and knowledge of professionals who are well-versed in the legalities surrounding debt recovery.

These collection agencies employ staff who are trained in current legislation governing collections, including the Fair Debt Collection Practices Act (FDCPA) in the United States, and similar regulations in other jurisdictions. Compliance with these regulations is essential for avoiding hefty fines and reputational damage that can arise from violations. By outsourcing collections to a skilled collections call center, organizations can be confident that every interaction with debtors adheres to legal standards, thus minimizing risk.

Moreover, reputable collection agencies not only maintain compliance but also have established processes to deal with various legal challenges that may arise during the collections process. They utilize tools and methodologies that ensure ethical collection practices, emphasizing consumer rights while effectively recovering debts. This commitment to compliance also extends to data protection laws, ensuring that sensitive information is handled appropriately and that clients remain in good standing with regulatory agencies.

Ultimately, outsourcing collections allows businesses to focus on their core activities while reducing the burden of managing potential legal complications. By aligning with an experienced collections partner, organizations can shift their focus toward growth and operational success without the constant worry of legal pitfalls associated with in-house collections management.

Measuring Success and ROI

As businesses consider outsourcing their collections, it becomes imperative to measure the success and return on investment (ROI) of these initiatives. Implementing a systematic approach to evaluate the effectiveness of collections can provide insights that guide future decisions. Key performance indicators (KPIs) serve as valuable metrics, allowing organizations to understand the impact of partnering with an outsourcing provider, such as a Philippine call center.

One important KPI to track is the collection rate, which gauges the percentage of accounts successfully collected within a specified period. Monitoring this metric can reveal the efficiency of the outsourced collections team. Another crucial KPI is the cost per account collected, which provides an understanding of the expenditure involved in the collections process. By comparing this cost against the revenue generated through collections, businesses can assess whether the outsourcing arrangement is financially beneficial.

Additionally, it is vital to measure the average days to collect. This metric assesses the efficiency and speed of the collections process, enabling businesses to evaluate how quickly outstanding debts are being resolved. In a similar manner, the first call resolution rate should also be considered, as it indicates the effectiveness of the collections call center in managing interactions with clients. A higher rate suggests a more skilled team, reducing time and cost in recurring calls.

To accurately calculate ROI, organizations should account for both the direct costs associated with outsourcing collections and the financial gains derived from recovered debts. The formula for ROI can be structured as follows: (Net Profit from Collections – Cost of Outsourcing) / Cost of Outsourcing. By utilizing these key metrics and ROI calculations, businesses can effectively measure the success of their outsourced collections initiatives, ensuring informed and strategic decision-making for future operations.